In Part 16, Avaria went from having one bank to having five banks in a pretty short time. We also saw that the bankers and their investors started getting greedy, pushing their reserve ratios down lower and lower. I described it as a house of cards.

So what will we do this week to give a little push to this house of cards?

Let’s say the farmer has a bad crop. Maybe there was an early frost. These things happen. And it means that one of the primary sources of new wealth for the society didn’t produce as much this year. Unfortunately, a lot of people were planning on that additional wealth coming into society, so let’s trace the ripple effects of this bad crop.

First, the farmer, ever since buying the tractor and expanding his farm, has been hiring a lot of farm hands lately. Suddenly he doesn’t need them for several months.

And then there are all of the people who are normally employed to help transport and process and re-sell all the food the farmer harvests. They all lose a large portion of their income as well.

When you start adding up all the people who just lost some or all of their annual income, it comprises a large minority of society. And what do people do when they are suddenly impoverished? They especially cut back on luxury items.

With business recently booming in society, primarily because of the influx of cash that gave the Avarians the illusion of greater wealth than they really had, a lot of companies selling luxury items were cropping up and growing quickly, and they were borrowing a lot of money to rapidly increase production capacity. But their sales started dropping as the money price of things adjusted, which caused that illusion of wealth to start to dissipate. And then their sales took a further plunge as a result of the bad crop and resultant shortfall of wealth in a large chunk of society. Those dropping sales led to those businesses defaulting on their loans. Some factories that were half-built had to be scrapped entirely. Many half-made products were never completed. Beautiful new stores were abandoned. What a waste of wealth! And this business-related waste of wealth is in addition to the loss of wealth (relative to expectations) that the bad crop instigated. It’s a powerful example of how damaging uncertainty in an economy can be. And the most potent inducer of uncertainty is when money doesn’t have a stable value because money prices no longer are accurate at indicating the wealth price of things, so nobody can accurately gauge how much wealth they have and how much wealth they are spending.

So now we have a lot of businesses that have defaulted on their loans, and surely a lot of families as well. Therefore, the default rate of commercial loans and private mortgages is rising quickly. And who do you think gets hit the hardest by all these loan defaults? Yes, of course, it’s the people who own all the loans–the bankers. They, after all, are the ones lending out the majority of money in society.

Let’s say the problems start with Independent Bank. As the newest bank, it was being extra aggressive to try to play catch up with the other banks and earn its fair share of the market, so it was pushing its reserve ratios the lowest by making as many loans as possible, including to risky borrowers. And then, when it stopped receiving payments on a large percentage of its loans, for reasons that will be explained in Part 18, its gold coin supply in its vault became critically low.

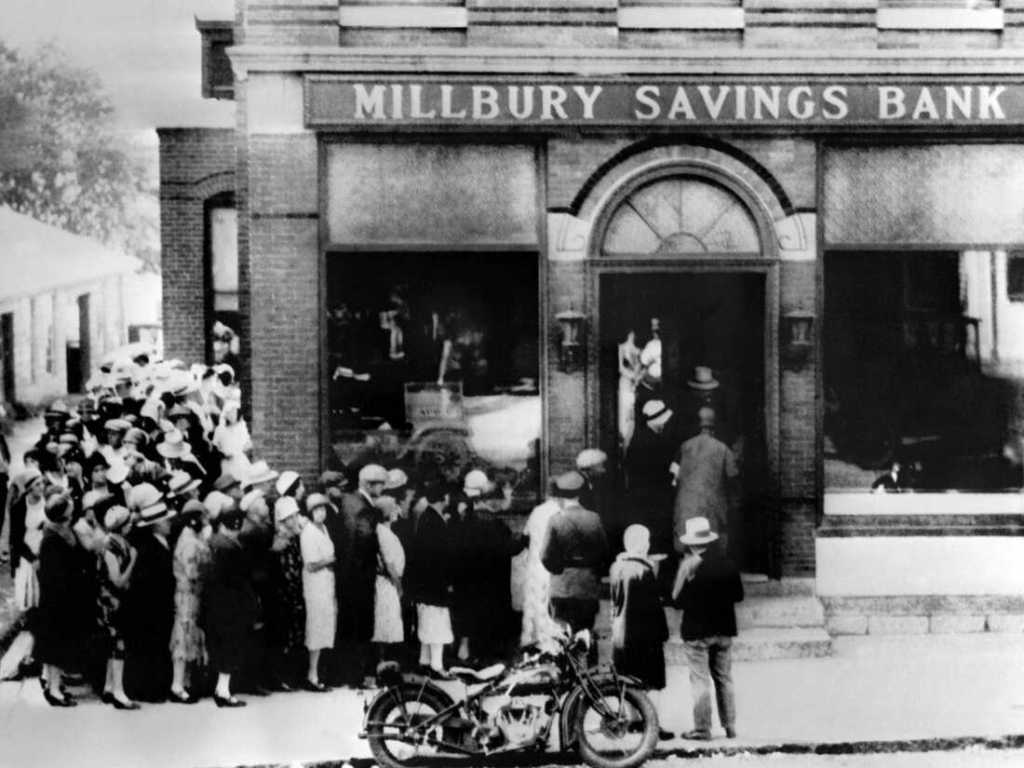

One of the employees walks into the vault and sees that the bank is almost out of gold coins. He runs home and tells his family members that they better exchange their Independent Bank Goldnotes quickly because the bank is going to run out of gold coins soon. So they all run to the bank and line up, asking for specie in exchange for all their Independent Bank Goldnotes. Other passersby see the line and ask what’s going on, and the people in line tell them the bank is running out of gold and that they better redeem their Independent Bank Goldnotes quickly. The people already in line are happy to share the news with others because it’s exciting and because it won’t hurt them if others get in line behind them.

In this way, the news spreads, and the line grows longer. Within another few hours, Independent Bank is going to be completely out of gold, which would mean telling its depositors that they can’t get specie anymore and then having to liquidate its assets to try to repay them. Independent Bank is on the verge of failure.

This is Avaria’s first bank run! How exciting, right?

Does this mean we have a societal default on our hands? There are a lot of people defaulting on loans, but I would say it hasn’t necessarily led to a full-blown societal default yet.

But never fear–the owners of all the banks see what’s happening. They see that this could go downhill for all banks real quick if people start worrying about the reserves in them as well and then start lining up at their teller windows too. That means their entire system of massive wealth generation for themselves (i.e., aggressive fractional reserve banking, which is the house of cards) could completely topple! They need a solution, and fast. In Part 18, I’ll further clarify Independent Bank’s financials to show how it ran low in gold coins, and then in subsequent posts I’ll move on to explaining the solution the bankers came up with.