Have you noticed the trend I’ve noticed about what people do when they become aware of some issue with an economy? It’s super predictable once you become aware of it. They jump from “there’s this issue with the economy” straight to “government needs to intervene to solve it.” And then they proceed to advocate for some kind of government regulation over how the economy works.

This post was spurred by watching this YouTube video (“You’ve Been Lied to About Food Prices”) by the truly excellent journalist, Johnny Harris. He talks about several reasons food prices have gone up lately. One of those reasons is the far-flung supply chains that make us so interdependent that any human conflict or natural disaster will have price-increasing reverberations throughout the world economy.

Then he talks specifically about egg prices. He revealed an important (and new-to-me) insight: The bird flu story was leveraged as a consumer manipulation strategy to justify higher egg prices.

But that doesn’t fully make sense unless all companies in the egg industry are colluding, either explicitly or tacitly, and using the bird flu story as a cover. Because otherwise any company that tries to raise their prices based on this bird flu-induced supply shock narrative will just lose market share to competitors who are willing to continue to sell eggs at the prior price and, thereby, win new customers.

Sure, I guess the bird flu story could influence price negotiations to give the egg sellers a little bit more leverage across the board. But still, any egg seller trying to raise prices will, at least in the medium or long term, lose customers when other egg sellers defect from the collusion (as is their incentive) to win market share and greater profit.

Anyway, the sadly predictable next step in Johnny’s logic flow–after talking about all these reasons why food companies are jacking up prices and making more profits–is to look to government to intervene. Those government interventions usually boil down to controlling prices or dictating supply in some other way. Sometimes governments even do the equivalent of controlling demand simply by regulating away options from the market, thereby neutering certain aspects of demand.

This is the predictable next suggestion that almost every person makes if they espouse the modern idea about governments that they are tools to be used for good in society wherever they can. But even people who don’t espouse that government-as-the-everything-tool idea, such as “anti-big-government” conservatives, make very similar suggestions (albeit couched in different wording that appeals to a different political tribe). Regardless of which political tribe a politician (or journalist) is in, they all tend to propose using government interventions to fix problems in the free market.

So, after discussing food prices, Johnny describes solutions, all of which rely on government interventions in some way. He even details in a pretty positive light the price controls the Mexican government instituted and how they have benefited Mexicans.

I don’t know why a fundamental misunderstanding of how capitalism works has crept into the political tribes all over the world, but I suspect one reason is simply that people don’t understand economics. That ignorance isn’t new, but it was prevented from becoming a problem during the cold war years when anything that even slightly resembled communism (and, to some extent, socialism) was firmly rejected. And now that communism is no longer the cultural villain it once was (as the culture of the boomers loses its cultural influence), the same ideas about government intervening in markets are much more accepted. This may explain why the likely soon-to-be mayor of New York City, Zohran Mamdani, is an avowed socialist who talks, among other things, about heavily taxing the wealthy, providing government-run (municipally owned) grocery stores with government-dictated prices, creating new rent price controls, and increasing the minimum wage to $30/hour by 2030.

For the rest of this article, I will do my best to explain specifically why these uses of government in the economy are so destructive and why they always, sooner or later, achieve the opposite of their intended effect.

To do that, I’m basically going to re-write Friedrich Hayek’s seminal essay, The Use of Knowledge in Society, published in 1945, which definitively and eloquently explains the foolhardiness and sheer potential destructiveness of attempts to use government market interventions to solve economic problems. Hopefully my rendition of his essay will be easier to understand for the modern human but will still convey clearly and persuasively the main insights. I’ll definitely leave out several sections that are ancillary points not relevant to a modern audience. But I’ll also quote him heavily because there are sections of that essay that are so beautifully and articulately written that I can’t help but quote them in full. Let’s get into it . . .

Our goal, from an economic perspective, is to construct a “rational economic order,” which I would interpret as an economy that works at maximum efficiency and produces exactly the goods that consumers want. This is logically achievable if we can possess all the information requisite to do that, which includes all details about the means of production and consumer preferences. Mathematically, the optimal answer is arrived at when the marginal rates of substitution between every commodity is the same.

This is mathematically solvable . . . but, the problem is, our true challenge lies in acquiring the societal knowledge necessary to solve the problem because “the ‘data’ from which the economic calculus starts are never for the whole society ‘given’ to a single mind . . . and can never be so given.”

I said some parts of this essay are so beautifully written that I need to quote them in full, and this is one such part: “The peculiar character of the problem of a rational economic order is determined precisely by the fact that the knowledge of the circumstances of which we must make use never exists in concentrated or integrated form but solely as the dispersed bits of incomplete and frequently contradictory knowledge which all the separate individuals possess.”

So, in summary, if we are to construct a rational economic order, the challenge lies in obtaining the data from which it can be calculated because those data (or, “knowledge,” as Hayek terms it) are “not given to anyone in its totality.”

Economists of Hayek’s day seem to have gotten lost in the weeds of mathematics and missed this main point that they can never use mathematics to solve a problem for which they don’t have the necessary input data.

Before we get into more details about how and why those input data (“knowledge”) are dispersed and so hard to obtain, let’s first clarify the definition of a term that we will be using frequently in that discussion: “planning.”

Planning in an economy happens whenever people are somehow collaborating to organize economic activity. Hayek defines his use of the term as “the complex of interrelated decisions about the allocation of our available resources.”

So while this isn’t a modern way of talking about “planning” in an economy, Hayek is making the point that an economy requires planning of some kind for it to achieve the goals of efficiency and suitability to consumer preferences. As you’ll see, he’s using the term “planning” to broadly include any person or mechanism that serves to coordinate those “complex and interrelated decisions.”

Now, since the knowledge a planner would require starts out as dispersed–and the reasons for the dispersed nature of that knowledge will be explained shortly–first that knowledge would have to be conveyed to the planner in some way.

Thus, having one central authority for the whole economic system (a central planner) would be pretty difficult because that’s a lot of information to receive and process and then a lot of instructions to convey once the planner has formed their conclusions. Alternatively, then, the task of planning could be divided among many individual planners (decentralized planning). The option that can be expected to be most efficient is whichever one will most completely obtain existing knowledge and then rapidly put it to use.

This leads to a discussion about specific different types of knowledge that will be required for the planner(s) to have and use.

First, there is scientific knowledge. If this were the only type of knowledge, a body of suitably chosen scientists could do a great job planning the economy. But, unfortunately, there are other kinds of knowledge that also need to be integrated into the economic plan. The second type of knowledge is what Hayek calls “the knowledge of the particular circumstances of time and place.” And this is the knowledge type that “practically every individual has some advantage over all others because he possesses unique information of which beneficial use might be made, but of which use can be made only if the decisions depending on it are left to him or are made with his active cooperation.”

To illustrate this second kind of knowledge (which I guess we could call “non-scientific knowledge”), think of a factory manager. Any given factory has a wide range of potential output efficiencies, and it’s up to the factory manager to achieve the highest efficiency possible, generally through, as author James Clear puts it, “the accumulation of marginal gains.” This factory manager has an incredible amount of knowledge to help him with this task, including which of his workers would be best suited to specific tasks, which of his machines are not being put to their full potential output, which processes could be adjusted to take better advantage of his workers’ and machines’ capabilities, which local conditions and circumstances will help get the most out of his employees, etc.

Another illustration of the relevance of this non-scientific knowledge in the task of planning an efficient economy is someone who has worked in various parts of the shipping industry and has become aware of a potential business opportunity after observing that most shipping containers have unused weight and space capacity. Not only does this person have the understanding of the typical shipping lanes through which the right kind of products are flowing that could be added to fill the excess shipping container capacity, but they have the human connections necessary to talk to the right people at both ends of a route and make that business idea become a reality.

Let me make explicit a really important point from those two illustrations: Every time someone makes use of this non-scientific knowledge to generate profits for a business, they are performing an “eminently useful” function by capitalizing on their “special knowledge of circumstances of the fleeting moment not known to others.” Essentially, they are extracting every bit of inefficiency out of the economy, and the profit their company receives as a result of that effort is a small price to pay for the added economic efficiency.

Hayek then speculates on why this non-scientific knowledge’s importance is underappreciated in his day. I don’t have to review the specific details of his musings on that, but he saw it as one more factor that was pushing his contemporary economists toward believing that central planning could adequately achieve a rational economic order. This is a running theme of the essay–Hayek was not only trying to provide insight into how best to achieve a rational economic order, but also he was trying to provide insight into the barriers to understanding these insights that many of his contemporaries faced. Most of those barriers addressed by Hayek in his essay no longer apply to today, but I think getting to the core of what factors are perpetuating economic ignorance today is something worth working on since it’s probably the root of most misguided and economically harmful policy proposals (and their support).

Next, we have to discuss a specific characteristic of those two types of knowledge that a planner needs that we haven’t explicitly addressed yet: change.

The ever-changing nature of scientific and non-scientific knowledge is what makes the task of a planner orders of magnitude more formidable. “Economic problems arise always and only in consequence of change. So long as things continue as before, or at least as they were expected to, there arise no new problems requiring a decision, no need to form a new plan.” I believe this characteristic of knowledge is even more significant than it was in 1945 due to the ever-increasing rate of economic change through more and more advanced technology that allows even faster rates of change.

This ever-changing nature of knowledge explains why you can’t just build a factory and, thereafter, assume “the rest is all more or less mechanical, determined by the character of the plant, and leaving little to be changed.”

Hayek doesn’t have a high opinion of his contemporary economists’ understanding of this point, and he suspects that it’s because they lack “the practical experience of the businessman.” They’ve never seen how much effort and skill and constant struggle is required on the part of a manager to optimize the profitability of a factory, taking into account not only the scientific and non-scientific knowledge they are privy to, but also given the ever-changing nature of that knowledge that requires weekly, daily, and maybe even hourly pivots. I love the section in Hayek’s essay that explains this point further: “The continuous flow of goods and services is maintained by constant deliberate adjustments, by new dispositions made every day in the light of circumstances not known the day before, by B stepping in at once when A fails to deliver. Even the large and highly mechanized plant keeps going largely because of an environment upon which it can draw for all sorts of unexpected needs; tiles for its roof, stationery for its forms, and all the thousand and one kinds of equipment in which it cannot be self-contained and which the plans for the operation of the plant require to be readily available in the market.”

And now let’s add one more challenge to the planner’s effort to obtain this knowledge. Hayek writes, “The sort of knowledge with which I have been concerned is knowledge of the kind which by its nature cannot enter into statistics and therefore cannot be conveyed to any central authority in statistical form. The statistics which such a central authority would have to use would have to be arrived at precisely by abstracting from minor differences between the things, by lumping together, as resources of one kind, items which differ as regards location, quality, and other particulars, in a way which may be very significant for the specific decision. It follows from this that central planning based on statistical information by its nature cannot take direct account of these circumstances of time and place and that the central planner will have to find some way or other in which the decisions depending on them can be left to the ‘man on the spot.'”

To illustrate that last point, think of his example of the factory needing new roof tiles. This isn’t something a central planner is ever going to be able to anticipate (“which by its nature cannot enter into statistics”) because it’s unknown how long the specific tiles used on the factory’s roof will last. They could guess, based on historical information about how long tiles typically last, how many tiles should be sent to each factory with those specific roof tiles, but odds are incredibly high that they’ll be stacked up and unused (along with a million other random supplies) and lost in some part of the factory. Or they’ll be taking up some crucial storage space and finally someone will decide to just move them outside, where they degrade and crack. So now we have an inefficiency in the economy because tiles are getting wasted and cumbering limited space. Or, the alternative scenario is that those original tiles were faulty, so tons of new ones are needed, and pretty soon the manager realizes he needs to just get a completely new roof or find a new kind of tile to retro-fit the existing roof and expect to replace more of the old faulty ones on a daily basis. And since those needs never could have been anticipated, the factory gets a leaky roof while new tile requests are sent up to the planners, creating a big delay, and worsening working conditions in the meantime, maybe even triggering workplace exposures like mold inhalation that could cause headaches and decreased worker efficiency. And machines could get dripped on and rust out earlier than expected, which causes an unanticipated shortage of whatever the factory was making, and so forth, until the reverberations of inefficiency from a simple tile defect and shortage continue to spread throughout the entire economy.

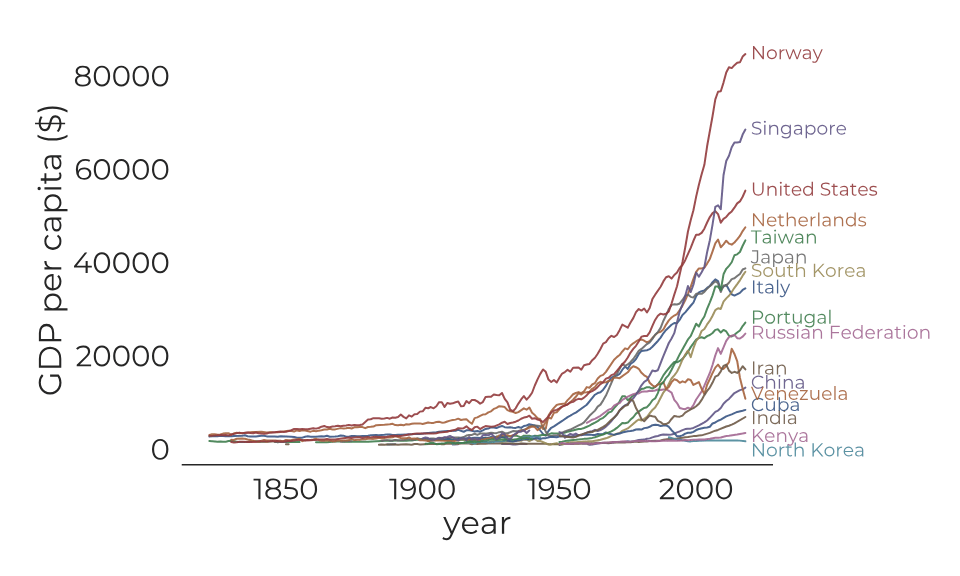

As an aside, people sometimes wonder why the United States fared so well after WWII and the U.S.S.R. did not. This is what central economic planning gets you–innumerable little inefficiencies that lead to more inefficiencies that lead to even greater challenges with central planning, until ultimately the system collapses and reverts back to a form of decentralized planning that actually works really well (we’re getting there). This is why they had to build a wall to keep East Germans in–because the economy of East Germany was so inefficient due to central planning that the country was in deep poverty compared to right across the wall in West Germany, so people wanted to get out. It’s the same with North Korea and its extensive walls today–they’re primarily to keep people in rather than to keep people out.

Anyway, the foolhardiness of attempting any form of central planning should be clear by now; there’s no way to obtain all the requisite information, and even if all that information could be obtained, there’s no way to integrate it and communicate optimal answers in a timely way to each possible question that arises about how best to use limited resources. Thus, a decentralized planning mechanism is obviously much better.

So how well would relying on decentralized humans do? It would ensure that the local non-scientific knowledge (“knowledge of the particular circumstances of time and place”) could be promptly used, but the problem remains of “communicating to him such further information as he needs to fit his decisions into the whole pattern of changes of the larger economic system.” In other words, how would we coordinate the decisions of all those decentralized planners? How would the tile designers and the tile factory quickly become aware of the needs of a new retrofit tile across the country, and how would the clay supplier be notified that they need to start shifting their harvesting efforts to a different clay composition, etc.? Economies are so interdependent that, to fully coordinate the decisions between all of those planners, you would need them to be making decisions that optimally integrate with the entire world economy. In Hayek’s words, “There is hardly anything that happens anywhere in the world that might not have an effect on the decision [each decentralized planner] ought to make.” Obviously, the conclusion here is that even decentralized planners would be woefully inadequate.

Is there a better alternative? Yes. We already know that we need each individual to be making their own decisions about how to focus their limited resources to optimally respond to their own situation, but we’re still left with the question of how to coordinate their choices with the rest of the millions or billions of individuals doing the same thing.

Fortunately, to accomplish that coordination, the “man on the spot” decision maker doesn’t need to know all the details of every aspect of the world economy to be able to coordinate his decisions with it. “It does not matter for him why at the particular moment more screws of one size than of another are wanted, why paper bags are more readily available than canvas bags, or why skilled labor, or particular machine tools, have for the moment become more difficult to obtain. All that is significant for him is how much more or less difficult to procure they have become compared with other things with which he is also concerned, or how much more or less urgently wanted are the alternative things he produces or uses. It is always a question of the relative importance of the particular things with which he is concerned, and the causes which alter their relative importance are of no interest to him beyond the effect on those concrete things of his own environment.”

And this, finally, brings us to the solution of how to help every individual involved in an economy (every “man on the spot”) to coordinate their efforts with everyone else: prices. They are a form of constantly updated “equivalence” or “marginal rates of substitution.” In other words, they’re a means of “attaching to each kind of scarce resource a numerical index which cannot be derived from any property possessed by that particular thing, but which reflects, or in which is condensed, its significance in view of the whole [economy].”

How amazing is that? I suspect most people in the world today take prices for granted. They have no idea that each individual price is essentially a summation of billions of tiny pieces of knowledge that reside in the minds of millions or billions of different people. They have no idea that prices are an incredibly efficient (and simple!) means of solving the most intractable problem modern economies have, which is that of coordinating every single aspect of an economy to operate in an efficiency-optimizing way, all while taking into account the individual preferences of every single human that is even remotely connected to that economy. In short, prices are the core of how we construct a “rational economic order.”

Think about it in a more personal way. Whenever you make a choice, at home or at work, about how you will spend your/your employer’s limited resources, you are taking into account your preferences and needs and then determining, consciously or not, which option will be the highest-value one to meet your needs. In other words, your preferences (condensed into your estimation of the “quality” of a thing) and the price are coming together to help you make an optimal value choice for yourself, and that decision is then reflected in future pricing to be integrated into the entire world economy.

Prices are never perfect, of course. They lag behind individual decisions a little bit and sometimes a lot. They are sometimes skewed by irrational (non-self-optimizing) decisions that humans are so susceptible to making. They can be messed up by companies exploiting consumers. And so forth. But these are only issues in the short and medium time horizons. In the long run–in the absence of government interventions that can cause market imperfections to persist indefinitely–prices always tend toward their optimal value to help create a rational economic order. Even issues like monopoly pricing (either from an actual monopoly or from a group of companies acting as a monopoly through collusion) are self-correcting because of the price system. Monopoly prices are higher than would otherwise be optimal, which leads to excess profits being reaped in that industry, which motivates new entrants or, if new entrants are locked out, disruptive innovations that fulfill the same job for consumers but in a different and higher-value way. So even something like the natural monopoly of a fibre optic internet provider who was the only one to lay cable when a community was being built and is charging monopoly prices to that community for high-speed internet will eventually have their power to continue to do monopoly pricing disrupted by newer technologies such as cellular or satellite internet.

So, yes, prices are imperfect. Really, the only way to craft a perfectly rational economic order is to have an omniscient god who is also able to simultaneously communicate to each individual person the optimal use for limited resources in every instance. But, until an omniscient god comes around and starts telling us what to do in every instance, we are left with the imperfect price system.

If you could compare the efficiency of the price system to the omniscient god system, I suspect it would perform just ok. But compare the efficiency of the price system to any other system we currently have available, and the difference in efficiency is vast. I already talked about the U.S. versus U.S.S.R., as one example. And the rest of the article up to this point serves to drive home the specific mechanics of why the price system is so much better than any form of human-generated planning, whether it’s centralized in a single planning authority or decentralized into many separate local planning authorities.

Finally, Hayek gives a specific example of how powerful prices are at helping coordinate and optimize the activities of the entire economy. Here it is in full:

“It is worth contemplating for a moment a very simple and commonplace instance of the action of the price system to see what precisely it accomplishes. Assume that somewhere in the world a new opportunity for the use of some raw material, say, tin, has arisen, or that one of the sources of supply of tin has been eliminated. It does not matter for our purpose—and it is very significant that it does not matter—which of these two causes has made tin more scarce. All that the users of tin need to know is that some of the tin they used to consume is now more profitably employed elsewhere and that, in consequence, they must economize tin. There is no need for the great majority of them even to know where the more urgent need has arisen, or in favor of what other needs they ought to husband the supply. If only some of them know directly of the new demand, and switch resources over to it, and if the people who are aware of the new gap thus created in turn fill it from still other sources, the effect will rapidly spread throughout the whole economic system and influence not only all the uses of tin but also those of its substitutes and the substitutes of these substitutes, the supply of all the things made of tin, and their substitutes, and so on; and all this without the great majority of those instrumental in bringing about these substitutions knowing anything at all about the original cause of these changes. The whole acts as one market, not because any of its members survey the whole field, but because their limited individual fields of vision sufficiently overlap so that through many intermediaries the relevant information is communicated to all. The mere fact that there is one price for any commodity—or rather that local prices are connected in a manner determined by the cost of transport, etc.—brings about the solution which (it is just conceptually possible) might have been arrived at by one single mind possessing all the information which is in fact dispersed among all the people involved in the process.”

Hayek then says that the most significant fact about this price system is “the economy of knowledge with which it operates, or how little the individual participants need to know in order to be able to take the right action.” This truly is incredible. Through a single metric–a price–a consumer’s individual decisions are coordinated with the rest of the economy. And when any change occurs in any market, such as the scarcity of a one raw material, what happens as a result of that price changing? “Without an order being issued, without more than perhaps a handful of people knowing the cause, tens of thousands of people whose identity could not be ascertained by months of investigation, are made to use the material or its products more sparingly; i.e., they move in the right direction.” Hayek calls it a “marvel” and says that, if the price system had been the product of human design, it would be “acclaimed as one of the greatest triumphs of the human mind.”

Now think about the aggregate effects over time from humans stumbling upon this price system. It, in essence, allows people to coordinate in ways that would otherwise be impossible to them. And this coordination is what allows us to rely on each other’s knowledge to such an extent that humanity has been able to develop an almost unfathomable amount of division of labor and specialization, all of which is the driver of innovation. In short, our entire modern civilization is built upon the benefits that the price system has conferred.

The rest of Hayek’s essay is interesting but doesn’t add anything to the main points presented above, so this concludes my re-writing of his essay. I definitely encourage you to read it in full yourself to fully appreciate its majesty.

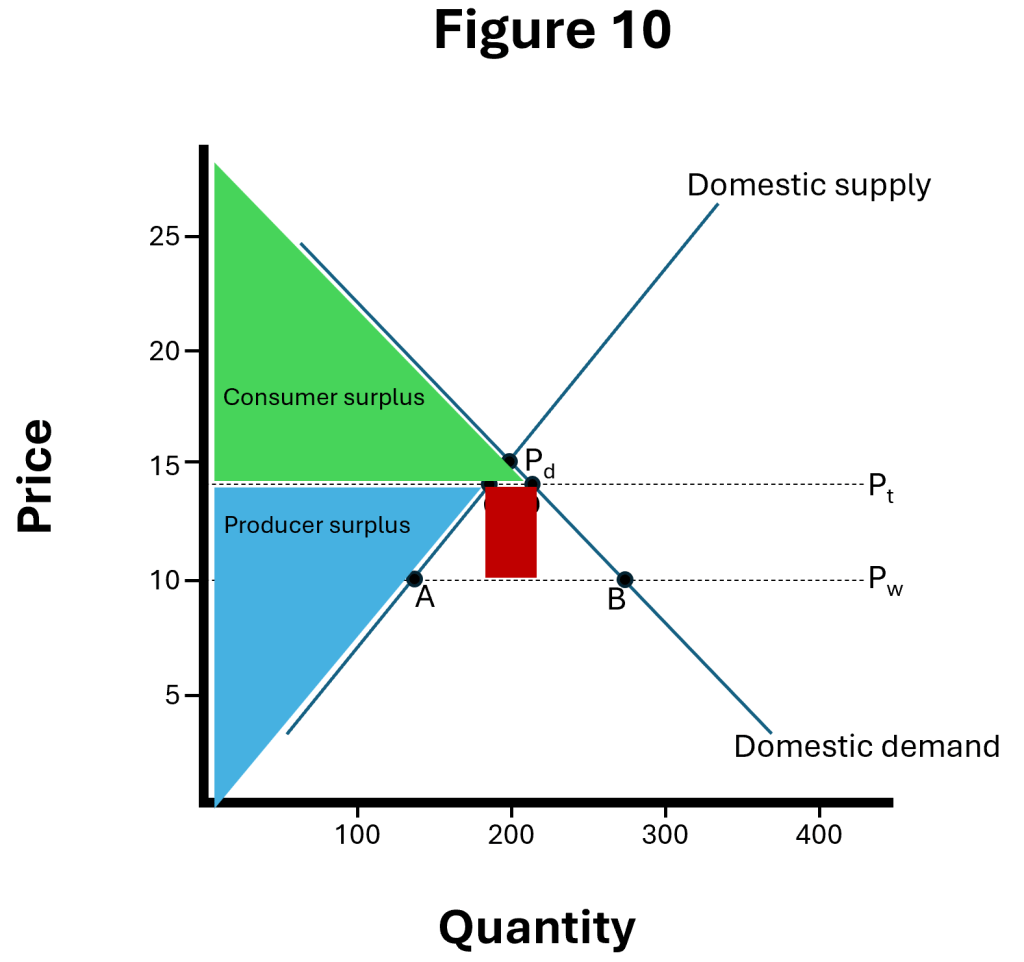

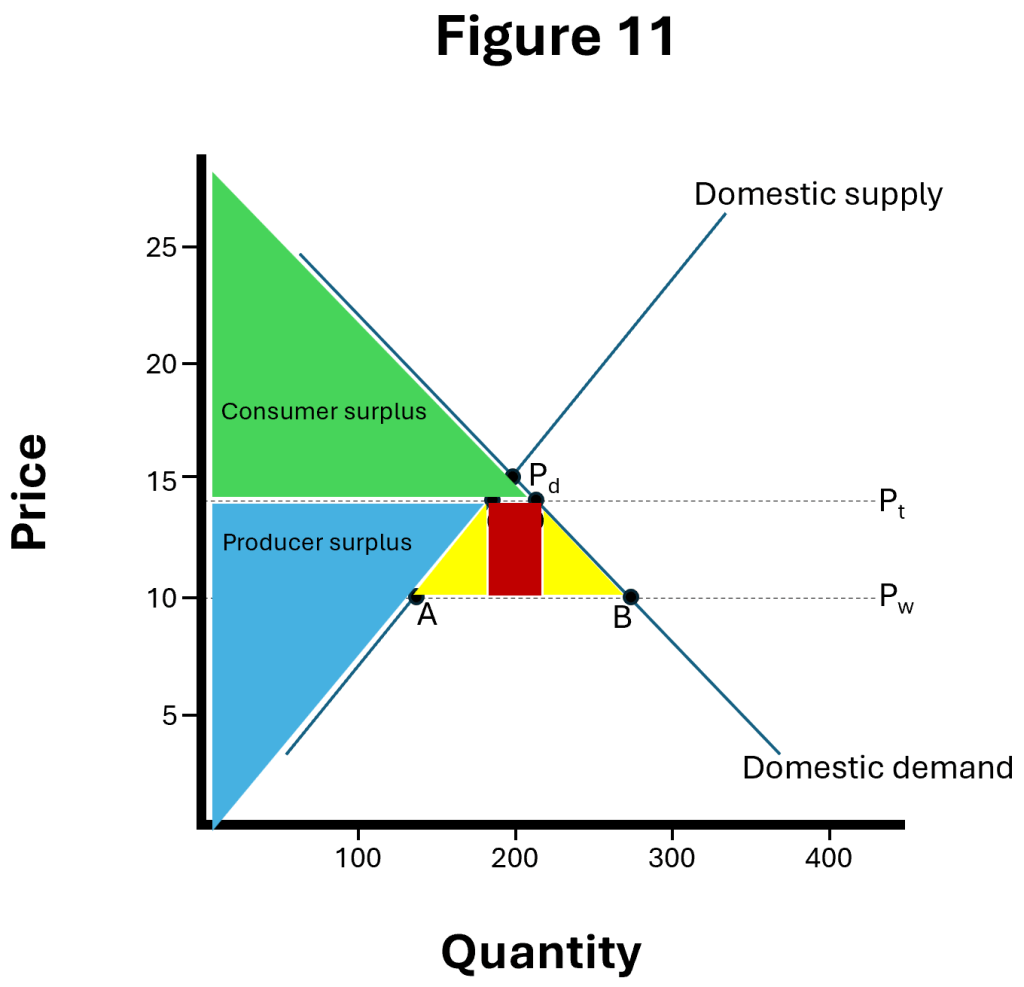

Now let’s go back to where we started. I hope you have a better understanding of why I have a particularly strong revulsion to any proposal for government economic interventions made in response to a perceived issue in the economy, including those that were discussed in the Johnny Harris video. Those government “solutions” almost always involve central planning in some form; in other words, they almost always disrupt the price system in some way. And the ensuing market inefficiencies destroy a huge amount of the future wealth-generating potential of the economy, leading to relative poverty in the future, which usually results in further and more extensive foolhardy attempts to manage the economy through government intervention, and the downward spiral continues.

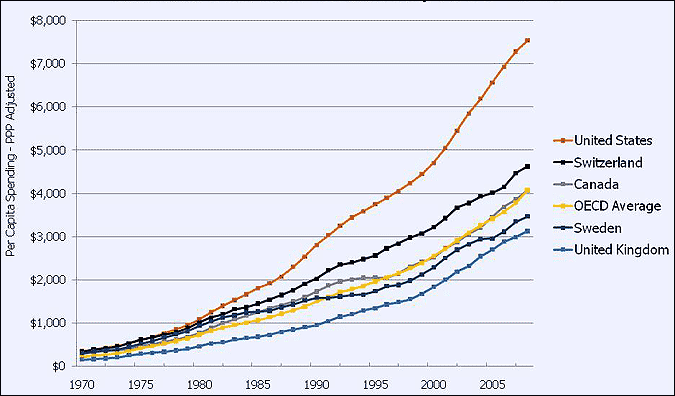

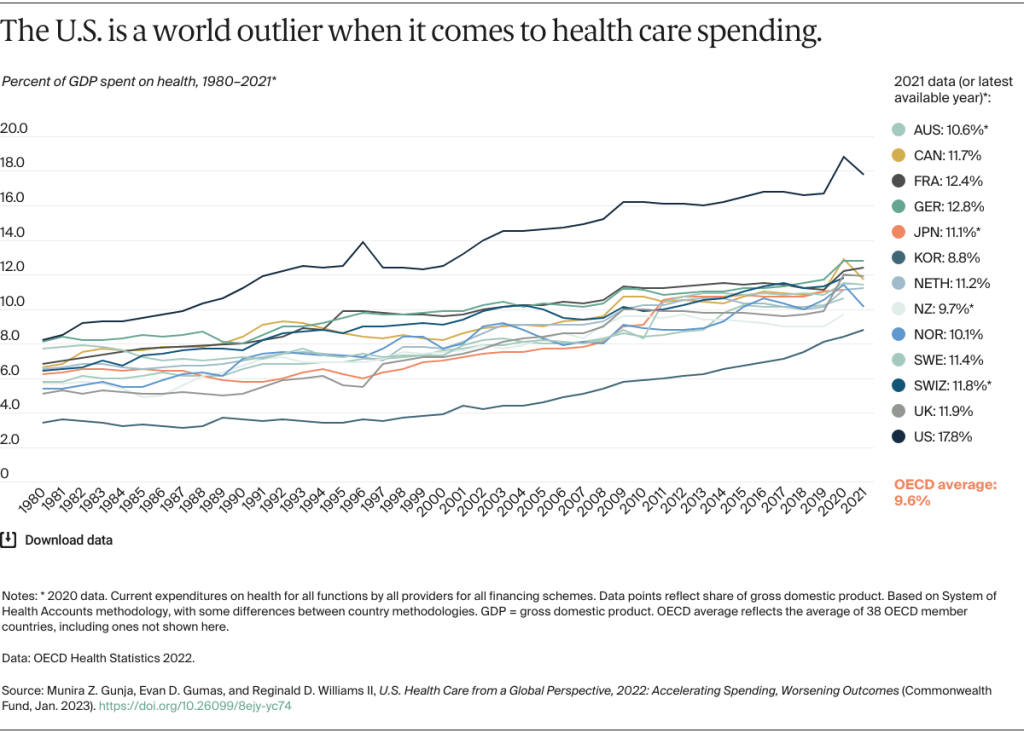

Hayek’s insights from this essay are foundational to my solution to our terribly inefficient healthcare system, and they also shed light onto why the price distortions from fiat currencies (explained in my Theory of Money series) are so damaging to an economy. This also further explains why the U.S. became a world healthcare spending outlier. All of these modern issues are, in a major way, connected to and directly arising from government-instigated problems with prices (i.e., government interference with the price system).

I will conclude with a personal note. I spend a lot of time and effort thinking about and writing about these issues (although more of my content is on X these days–it seems that blogs are less relevant than they used to be). I spend all of that time and effort not because this is my day job. In fact, I don’t earn any money from this work. But I keep doing it because my motivation is to impact society for the better; I want more people to understand the principles that underlie good government and economic systems. Because my belief is that if more people understand a good policy when they see one, they will be more likely to support it, which results in good policies becoming more likely to be enacted. And that will result in greater prosperity and happiness for humans. But often my motivation to improve society, and the time I spend on this endeavor, feels like a burden, especially when (1) I am so busy already with work and raising children and personal development (2) it seems that my efforts are not yielding the benefits I so strongly desire. I’m not sure what to do about all of that. It leads me to sometimes question, What’s the point of it all? I still don’t have an answer to that. Maybe I need to look into finding a way to profit from this work, which would probably require a huge increase in the time I dedicate and is unlikely to earn me as much as working extra shifts at the hospital. Plus I don’t know how I feel about a profit motive potentially tainting my incentives. Maybe I eventually just need to get into politics and try to make a difference more directly. But, until I figure any of that out, I hope this post at least helps some people out there learn something new. I hope it has helped you understand the importance of not messing with prices (directly or indirectly) and re-align your policy preferences accordingly. If it has helped you, drop me a line. Or if you have ideas of how to expand my reach and impact, also drop me a line. I just want to be helpful, and I’m not ready to give up on that just yet in spite of the burden it puts on my life.