In Part 5, I wrote about how the Wealth Unit:gold coin ratio adjusts as the market demands depending on how many WUs are needing to be stored in society’s total supply of cash and how many total gold coins are available to facilitate that.

In this post, I’d like to expand on that by discussing more about the factors that determine the value of money.

First, let’s recap from Part 1, where I explained how wealth is acquired.

Someone performing labor will typically be paid in accordance to the value they provided. It doesn’t matter so much what form the laborer’s compensation comes in as long as they receive something in return that has a value approximately commensurate with the value they provided. In this way, labor gets turned into an asset of value, which is wealth. That asset could be gold coins or chickens or partial ownership of a business or anything else.

Now let’s look more at the factors that can change the value of that stored wealth.

Historically, most societies have ended up using coins made of precious metals as money. This is for many reasons, but some of the mains ones are that they are intrinsically valuable, they don’t rot or die, they’re easy to divide into different valuations, and their value-to-weight ratio is reasonable.

But what happens if the value of the asset you received in return for your labor suddenly goes down? Say, you got paid in corn, but you stored it in your damp cellar and it got moldy? Tough luck. It’s like you didn’t work as much to store as many WUs because those WUs you earned are gone. This is why perishable things are not as handy for storing WUs. And it illustrates the risk of storing wealth. There will always be a risk to storing wealth; all we can do is try to minimize that risk.

For example, a good way to prevent your stored wealth from going bad is by storing it in a non-perishable form. But even non-perishable things are susceptible to their value changing in other ways. Even precious metals can have big swings in value depending on, of course, supply and demand, such as how fruitful the mines are, or how many other things people want to use them for (such as golden calf statues).

The thing with any commodity being used as money is that it has built-in mechanisms to keep its value relatively constant. For example, if a society starts getting really wealthy and is trying to store more and more WUs in the form of gold coins (including starting to build up piles of gold coins in their houses), the demand for gold coins (and, therefore, its value) has increased. In response to this, people will start acting differently.

For example, some people will start buying bronze necklaces instead of gold necklaces because the gold ones are too expensive now (i.e., consumers will find substitutes for gold, thus decreasing gold’s demand).

And gold miners will find ways to mine more gold (i.e., supply of gold will increase), such as by adding a night shift to their mining operation. They didn’t have a night shift running before because the cost of the lights and the higher cost of nighttime labor didn’t make it worth it, but now that the price of gold is so much higher it has become profitable to add that night shift.

The eventual result of all these market responses will be as follows: less gold will be demanded and more gold will be supplied. The combination of those two factors should be obvious–the price will drop. It might still be higher than it was initially, but not to an extreme degree.

My point is that market mechanisms will keep the price of any commodity being used as money relatively stable over time, which is a pretty important aspect of anything that’s going to be used to store wealth. So, to our running list of desirable features for whatever we choose to use as money, we could add “intrinsically valuable commodity,” or, maybe, “the price is subject to market forces.”

Sure, mining innovations may end up decreasing the number of WUs it takes to mine new gold, which might make it cheaper over time, but it’s just as probable that over time more uses will be found for this unique metal (especially as its price drops), so its price will probably stay fairly consistent. Additionally, remember the time period over which those changes in the value of gold are happening–probably over years and decades. A change in value of the commodity we’re using as money becomes less of an issue when it’s slow like that because those changes will only affect the longest-term financial plans and occasional recalibrations can be made in response.

In contrast, any form of money that can have rapid swings in value can totally ruin even the short- and medium-term financial plans of individuals and businesses. Investments–including short-term ones–become riskier, which alters the risk/benefit profile of investments and makes people less willing to invest in the innovations needed to generate more wealth for society (discussed in Part 3). So what I’m saying here is that investment will increase when the value of money is more stable. Remember this when we get to future forms of money in Avaria that have rapid swings in value. Anything that induces swings in the value of money will stifle investment.

Just for fun, I was trying to find the price of gold over the ages to see how well it has done at preserving its value over time, but there’s no simple answer available. Even comparing the amount of gold someone would be paid for a day’s worth of unskilled labor in ancient Rome to a day’s worth of unskilled labor today, the number of hours would differ, the working conditions would differ, the quality of the gold may be different, and the quoted ancient prices of gold may have been influenced by government price setting (such as by anchoring a gold piece’s value to a set ratio with the value of a silver piece). So I don’t have any reliable information to show how stable the price of gold has been over the ages.

But I hope my point is clear: No matter what you use as money, it’s always going to be susceptible to some degree to shifts in value (meaning the WU:money exchange rate will always be subject to change), so the best we can hope for is something that meets the other criteria for an optimal money (i.e., nonperishable, easily carried, easily divided into different amounts, etc.) and that its value will shift minimally and slowly. And having it be subject to market forces is a major boon to keeping a thing’s value more stable.

Now, let’s consider an example of changes in the WU:money exchange rate that is particularly relevant to our modern day. For the sake of simplicity, I’ll first describe a scenario using Avaria, and then I’ll talk about its application to modern day after that.

Let’s say our blacksmith invents a way to counterfeit gold coins. He takes some worthless metal refuse, stamps it into the form of a coin, and then plates it with a thin layer of gold. The deception will be found out sooner or later (like when someone tries to melt down the coin to make a necklace, or when the plating chips), but, until then, think about what would happen.

The total number of Wealth Units that people are storing in the form of gold coins hasn’t changed, but suddenly gold coins are much more plentiful. According to the calculation I introduced in Part 5 (True value of a gold coin = Aggregate-number-of-WUs-attempting-to-be-saved-as-cash / Aggregate-number-of-gold-coins), this will make the value of gold coins drop rapidly. In other words, each gold coin will now represent fewer Wealth Units. If someone has stored 1,000 WUs in the form of 100 gold coins (because the previous exchange rate was 10 WUs:1 gold coin), maybe now the exchange rate is only 5 WUs:1 gold coin, so their 100 gold coins are only worth 500 WUs now. Their purchasing power has been cut in half.

Things will self-correct once the counterfeits are found out, but what if those counterfeits are never found out? What if the blacksmith keeps counterfeiting more and more gold coins and they all stay in circulation?

The WU:gold coin exchange rate would continue to slowly adjust. What started as 10 WUs:1 gold coin would drop to 5:1 and then 1:1 and keep dropping as long as new counterfeit coins are entering circulation.

Money prices would adjust along with the WU:gold coin exchange rate. If the blacksmith’s cook pot used to cost 1 gold coin (because it’s worth 10 WUs), with the new WU:gold coin exchange rate of 1:1, the price would have increased all the way up to 10 gold coins. People would say, “Remember 10 years ago when everything was so cheap? We could get a good quality cook pot for a single gold coin.”

But remember that the wealth price of things has not actually increased. In fact, I bet innovation in the intervening years would have decreased the number of WUs that it takes to make things like cook pots. What has happened is that the asset people are using to store their WUs in has lost value/purchasing power.

In most countries today, we use paper money, which has negligible intrinsic worth. The government (or, the government’s central bank, which is called the Federal Reserve in the United States) can print as much of it as it likes. Each time they print* more money (like for a COVID-19 stimulus), the Wealth Unit:US Dollar ratio drops. Maybe in 2020 the ratio was something like 0.07:1, but now it’s dropped to 0.065:1. It’s a small change when I write it like that, but let’s think about this for a minute.

First question: Were any new wealth units created when the government printed that money? No. So there are the same number of total wealth units stored in the form of cash assets, but there are more total dollars now, which means each dollar represents less labor that it did before. The Wealth Units stored as cash have all been diluted over a larger total number of dollars.

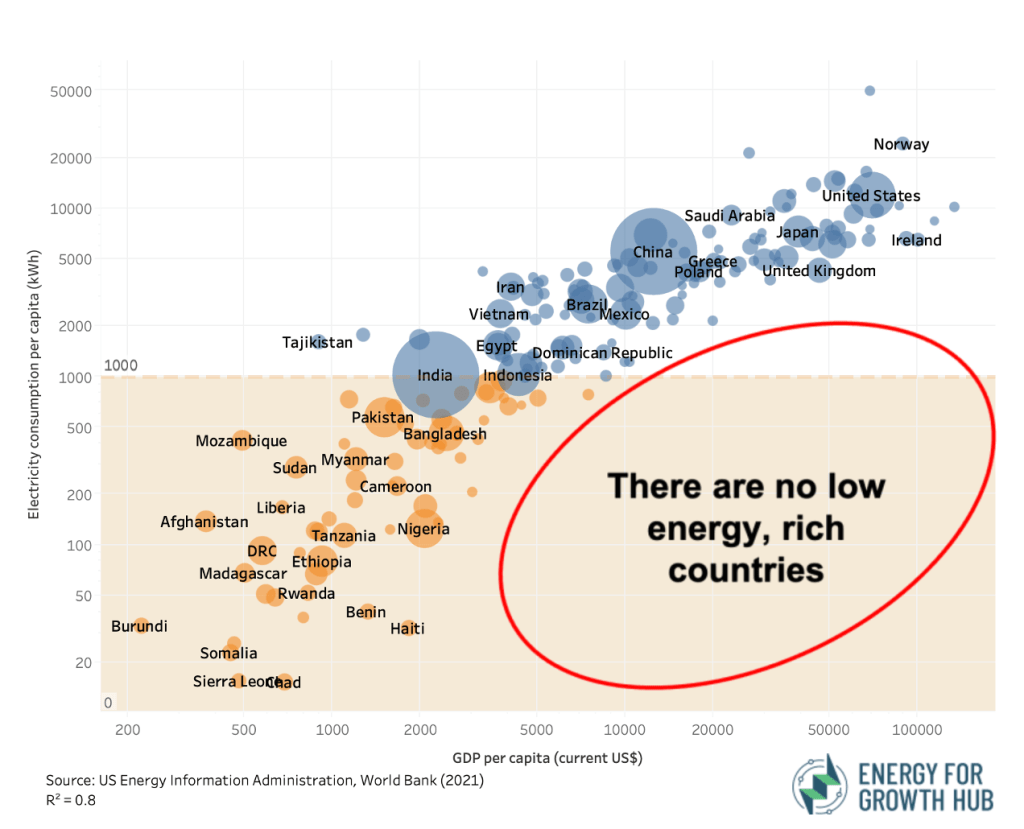

This is an important point. No new labor units were created! Printing money is not a way to make a society rich because money printing doesn’t generate more Wealth Units. It just dilutes the wealth already stored in the form of cash. Many politicians in the past–including the ones in charge of monetary policy–have misunderstood this! Even modern Ph.D. economists who advocate for this idea of “modern monetary theory” don’t understand this difference between money and wealth and, because of that, advocate printing money whenever the government wants to add a new program.

So if someone worked hard and earned 1,400 WUs and chose to store them in the form of $20,000 (when the exchange rate was 0.07:1), now how many WUs do they have after the government printed a bunch of new money and changed the exchange rate to 0.065:1? They still have $20,000, but it’s now worth only 1,300 WUs. This is a decrease of 7% of their cash-stored wealth, and if the government is doing that every year, it will be slowly but surely taking away this person’s cash-wealth savings without them even realizing how it’s happening! In fact, for every person who owns USD in any form, the U.S. government is taking away a percentage of their wealth every year that the government prints more money and induces inflation. In fact, since the Federal Reserve was established in 1913, about 97% of cash-stored wealth has been taken through inflation. That’s crazy!

In this way, the government is acting just like the blacksmith counterfeiting gold coins. They are not generating new Wealth Units; they’re just taking them from others through dilution of the money supply.

This is a good place to clarify what I believe is the most clear and useful definition of the term inflation. Inflation is a decrease in the Wealth Unit:money exchange rate through diluting the aggregate wealth stored in money over a larger total amount of money. Any other definition of inflation, including the ambiguous definition, “inflation is when a lot of prices rise in an economy,” are less useful because they fail to make explicit the difference between a rise in prices as a result of the diminution of the value of money as opposed to a general increase in the Wealth Unit costs of things (such as when global supply chains are disrupted from a pandemic).

One last interesting point. The government, when it prints this new money, is the first one to spend it. The act of spending this new money is what introduces it into circulation. And prices will only adjust after the new money has entered circulation. So, not only does the government have all this newly created money that it can spend (using wealth taken without permission from the people who own the already-existing US dollars), but also it gets to spend that money at pre-inflation prices!

Ok, this was a longer post than the others in this series, but I wanted to get to this stopping place. I have much more to say about the theory of money–we haven’t even invented banks yet!–so this series will be continuing for quite a while, and each additional post will build the foundation of knowledge needed for modern monetary systems to make sense, which is the pre-requisite to knowing which proposed monetary policies will be helpful and which will be detrimental.

*I’m speaking metaphorically. Generally these new dollars are not printed; they’re created in a computer at the Federal Reserve bank by simply changing the listed value of an account. But the effect is the same, so I prefer to use the term “printing money” because I think it conveys the idea more clearly.